How to Read a Fund Fact-Sheet

Has your adviser given you a factsheet on a recommended fund, and you need to understand what the terms mean? If so, read on …

Key Contents Of A Factsheet

Most fund factsheets will contain some or all of the following:

Fund Name

Many funds are commonly referred to by a short or abbreviated version of the full fund name. Hence it’s important to make use of the identifying codes (see below).

Fund Management Company & Domicile

The fund management company is structured and regulated according to the domicile of the fund. Common legal forms include unit trusts in the UK, SICAVs in mainland Europe, and mutual funds in USA (all are collective investment schemes). The reputation of the regulatory regime can vary greatly between domiciles, particularly in the offshore market.

Investment Objective

The investment objective is usually a short paragraph outlining the objective of the fund and key investment parameters, for instance maximum weighting towards a particular asset class, or particular characteristics of assets that may be acquired (market capitalisation, exchange where listed, sector, etc.).

Individual Fund Manager Name and Length Of Time In Role

Fund managers can sometimes become extremely well known and synonymous with the funds they manage. Examples include JP Natural Resources (Ian Henderson), Miton Special Situations (Martin Gray), Templeton Emerging Markets (Mark Mobius), etc. It’s worth being aware of when a strong fund manager leaves or moves away from direct hands-on responsibility for fund management.

Sometimes the fund will appoint a third party company as Fund Adviser or Investment Adviser.

Fund Manager Commentary

Factsheets often include a commentary written by the fund manager. Such commentaries can give a useful insight into the management team’s sentiment for the period ahead, or explanations for performance glitches in the recent past. Occasionally, they also give us an idea of the personalities behind the fund management team.

Assets Under Management

Some of the largest funds in the market comprise many billions of dollars. Some of the smallest, perhaps just a few million. Both can have disadvantages. The Total Expense Ratio of a small fund can be much higher than its peers, in percentage terms. For large funds, the problem can be that the fund becomes too big for its strategy to be effective, or to maintain its intended investment style. For example a fund focused on UK small-cap technology firms may need to change strategy if asset size becomes too large - there are only so many companies to invest in. This is sometimes called style drift.

Launch Date

An obvious common sense implication of this is that a track record of performance is a desirable attribute to look for. Regardless of the marketing story for a new fund, there are more unknowns than for a well-established fund.

UCITS Status

UCITS V is the latest version of Europe-wide regulations governing the creation and distribution of pooled investment funds, including mutual funds and exchange-traded funds. UCITS V is a stamp of EU-wide regulatory approval. A UCITS fund listed on one European exchange may be ‘passported’ to and distributed in all other member states.

The UCITS regime regulates area such as permitted asset classes as well as diversification (no individual constituent should represent more than 20% of a fund’s net asset value). It is increasingly being recognized worldwide as the mark of a stable, well-regulated investment product. Over 40% of net new UCITS sales are outside the EU, notably in Switzerland, South America and Asia. In Hong Kong, Singapore and Taiwan, for example, more than 70% of authorized investment funds are now UCITS-compliant (source: JP Morgan).

Share Classes

The factsheet should provide details of the various share classes available. Sometimes funds have a retail class, a broker class (fees structured to facilitate broker commissions) and/or an institutional class (where fees may be lower but the minimum investment significantly higher). The fund may offer shares in several investible currencies.

It is important to distinguish between base currency funds and hedged currency funds. For example, a fund house might have a fund with base currency and primary share class in USD, a second share class in EUR (where the core investment strategy is implemented in EUR with no protection against movements of EUR/USD), and a third share class which is hedged EUR - which closely follows the performance of the USD class, regardless of EUR/USD movements.

The abbreviations ‘Inc’ or ‘Dist’ denotes an income distribution share class where dividends are paid out to the investor on a periodic basis. The abbreviation ‘Acc’ designates accumulation shares where profits and dividends are retained in the fund to compound future growth. It is often the case that even with an ‘Inc’ share class the investor can make arrangements for income to be automatically reinvested into the fund.

Charges

Fund factsheets provided to potential investors should explicitly detail the fees and charges applied. For typical funds these will include a sales charge (bid-offer spread) and an annual management charge (AMC). The AMC plus with other charges not specifically stated are bundled together to give a TER (Total Expense Ratio) which is the best measure of fees applied on an ongoing basis. Alternative and specialist funds may carry a manager incentive or outperformance fee, for instance a percentage of profits over and above a given objective. The so-called ‘2 + 20’ structure (at one time most common for hedge funds) refers to 2% AMC on assets under management, plus 20% of profits earned (possibly over some stated target return or ‘hurdle rate’).

Identifying Codes

Most funds will have a variety of identifiers. These are essential to use to ensure any trade or dealing instruction relates to your chosen fund - especially if the fund has multiple currencies, multiple share classes or both onshore and offshore versions.

- ISIN International Securities Identification Number Managed overall by the ISO, the International Standards Organisation (a global NGO). Individual countries are encouraged to use the ISIN scheme and manage ISIN code allocation through their respective National Numbering Agencies.

- SEDOL Stock Exchange Daily Official List Managed by the London Stock Exchange to maintain unique identifiers for each listed security.

- CUSIP Committee on Uniform Securities Identification Procedures Oversees the numbering scheme used in USA and Canada.

- Stock Tickers Some financial and news organisations use their own format for security identification. For example Bloomberg, Reuters and Yahoo.

Performance Data

Fund performance figures can be presented in many different ways; discrete monthly or annual percentages are common, as are trailing returns. Quite often the security price (NAV - net asset value) is not even quoted. Unfortunately, it’s not always easy to compare one fund to another or even to answer simple questions like ‘What was the total growth for the last five years’. This is the subject of a separate tutorial.

Performance Chart

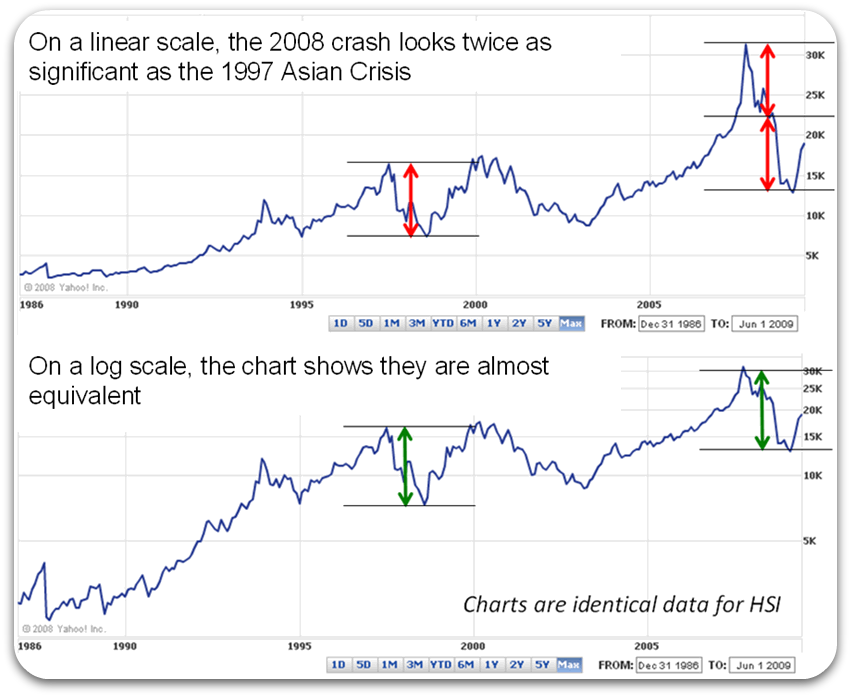

Pictures speak a thousand words, but that’s not always a good idea. Sometimes charts can be misleading, particularly if the chart is based on data other than cold hard real performance figures. Be especially cautious when figures presented are ‘back-tested returns’ (*see right) or other simulated data, usually the case for newer funds.

Be aware also of the human brain’s susceptibility to optical illusion. A logarithmic scale is sometimes more appropriate when looking at charts spanning several years or if there has been a significant price variation.

The two charts above display exactly the same data. The lower, logarithmic, chart conveys a better sense of the relative size of price movements: the amplitude of price movements will always be the equal if they are the same in percentage terms (regardless of the actual price).

Benchmark Or Index

When a performance chart is shown, usually the fund line will be displayed along with another line for a benchmark or index (or possibly the performance of the fund category as a whole). The purpose of a benchmark is to provide a means of comparing the fund performance, or the fund manager’s performance, against some kind of reference. This is important because a key concept of ‘active management’ is that the expertise and resources of the fund manager allow him or her to select a portfolio that will to some extent outperform the average. Unfortunately, this is certainly not always the case, which is one reason why index tracking funds or ETFs (exchange traded funds) are increasingly popular (as well as usually having lower fees).

Typical indices used as benchmarks come from providers such as MSCI, Dow Jones and FTSE.

Asset Allocation

A basic asset allocation will show the split in assets between cash, bonds, equities and possibly other classes of asset.

Geographical Breakdown

The geographical breakdown can sometimes include some surprises. For example an Eastern European fund might have USA holdings, perhaps because a Russian company is listed via ADRs (American Depositary Receipts) on the New York exchange.

Top Holdings

Factsheets will often list the top five or top ten holdings of the fund. This can reveal the extent of concentration (and hence comparative volatility) in the fund’s portfolio. For example, a fund where the top ten holdings account for over two-thirds of assets is far more concentrated than one where the top ten represent only one-third of assets.

Fund Custodian

If mentioned, a Custodian is usually a bank or other financial institution. The role of a Custodian is to act as an independent third party for holding and safeguarding the assets held within the investment fund. A Custodian may also act as the fund’s transfer agent, maintaining records of shareholder transactions and balances.

Star Or Crown Ratings

Some fund factsheets will quote ratings such as Star ratings from Morningstar or Crown rating from Financial Express. Be careful not to read too much into these - they are simply an indication of how the fund has fared against its peers over the last three years or more.

Morningstar rates funds from one to five stars based on how well they’ve performed (after adjusting for risk and accounting for all sales charges) in comparison to similar funds. Within each Morningstar Category, the top 10% of funds receive five stars, the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% receive one star. Funds are rated for up to three time periods: three, five, and 10 years; these ratings are combined to produce an overall rating. Funds with less than three years of history are not rated.

Financial Express on the other hand allocates up to three crowns: the top 20% of funds in their sector receive three, the next 30% receive two, and the bottom 50% receives one crown. As with Morningstar, funds with less than three years track record are not rated.

Star and Crown ratings are objective - quantitative - based entirely on a mathematical evaluation of past performance. They’re a useful tool for identifying funds worthy of further research, but shouldn’t be considered buy or sell recommendations.

Qualitative Ratings

Qualitative ratings such as those from Morningstar or OBSR (Old Broad Street Research Ltd, now part of Morningstar also) provide a more subjective view of fund quality. Analysts carry out research including meeting the fund management team and assessing processes and quality.

Morningstar rates firms on a five point scale from Elite down through Superior, Standard, Inferior and Impaired. OBSR offers a three point scale from AAA, down through AA to A. Supposedly, these ratings offer the chance to be more ‘predictive’ of performance in the longer term.

Standard Deviation

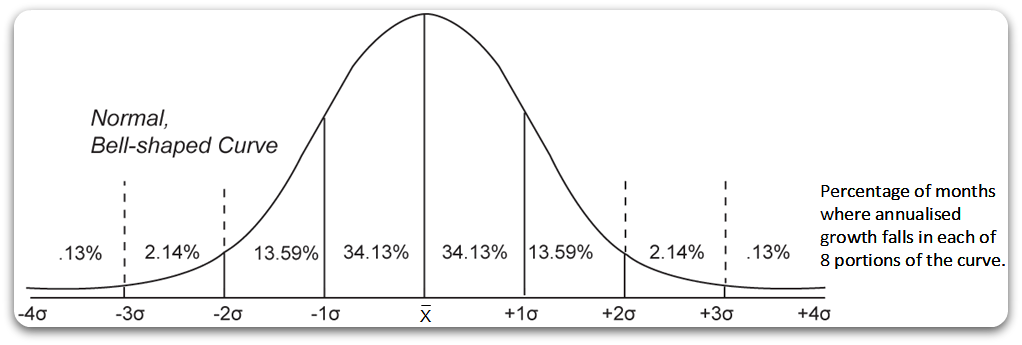

Some statistical measures can be particularly useful when comparing fund performances against each other, or against a benchmark. The most common measure of volatility is standard deviation, which is typically calculated using 36 months of data for annualised monthly returns. If a fund has a high standard deviation, then its range of performance has been very wide, indicating a greater potential for volatility.

X (actually ‘x-bar’), the mean, is the annualised average monthly return, ie the arithmetic mean. (May be just slightly different to the trailing three-year return, which is the geometric mean; but in practice we use whatever data we can get!)

For a normal distribution like the one above:

- 68% of months lie within 1 standard deviations of the mean, and

- 95% of months lie within 2 standard deviations of the mean.

For example: suppose a factsheet gives us the following data:

- 3-year mean return = 10%

- Volatility (standard deviation) = 20%

Then X = 10%, and one standard deviation σ is equivalent to 20% of that i.e. 2%. Hence, about 68% of the time, the annualised monthly returns have fallen in the range 8%-12%; and about 95% of the time, the annualised monthly returns were between 6%-14%.

If two funds have equivalent average returns, then the fund with the lower standard deviation indicates lower historical volatility for the same upside.

Sharpe Ratio

This is another common measure of volatility. It is calculated using standard deviation and excess returns (over and above the ‘risk free rate’, or sometimes against a target benchmark). Conceptually the Sharpe ratio gives the reward per unit of risk.

The higher the Sharpe ratio, the better the fund’s historical risk-adjusted performance. A negative Sharpe ratio means the fund has underperformed its benchmark or the risk-free rate.

A variation of the Sharpe ratio is the Sortino ratio, which removes the effects of upward price movements on standard deviation to measure only return against downward price volatility.