Current Global Interest Rates, and the Long Term Global Trend

(Reminder: Key interest rate definitions)

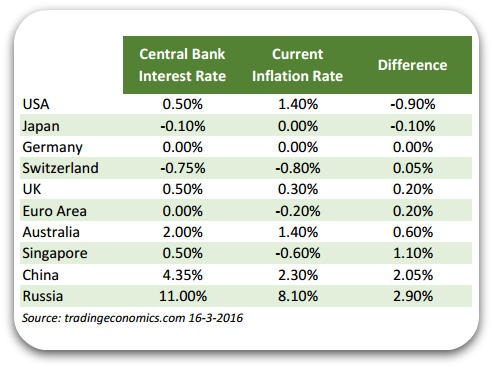

Since we’re all waiting to hear what the Federal Reserve will do with interest rates later today, I thought it would be helpful to take a quick glance at some other major economies.

The most likely long term trend for global interest rates is persistently low

Long term interest rates have been falling for thirty years, and a bunch of people way smarter than me think this is more likely to continue than otherwise.

Here are two fascinating reports:

December 2015, a staff working paper from the Bank of England.

July 2015, from the Executive Office of the President of the United States, no less.

In case you don’t want to spend a weekend reading them, here are some juicy bits…

First, from the Bank of England research:

“Long-term real interest rates across the world have fallen by about 450 basis points over the past 30 years. The co-movement in rates across both advanced and emerging economies suggests a common driver: the global neutral real rate may have fallen. In this paper we attempt to identify which secular trends could have driven such a fall. Although there is huge uncertainty, under plausible assumptions we think we can account for around 400 basis points of the 450 basis points fall. Our quantitative analysis highlights slowing global growth as one force that may have pushed down on real rates recently, but shifts in saving and investment preferences appear more important in explaining the long-term decline. We think the global saving schedule has shifted out in recent decades due to demographic forces, higher inequality and to a lesser extent the glut of precautionary saving by emerging markets. Meanwhile, desired levels of investment have fallen as a result of the falling relative price of capital, lower public investment, and due to an increase in the spread between risk-free and actual interest rates. Moreover, most of these forces look set to persist and some may even build further. This suggests that the global neutral rate may remain low and perhaps settle at (or slightly below) 1% in the medium to long run. If true, this will have widespread implications for policymakers - not least in how to manage the business cycle if monetary policy is frequently constrained by the zero lower bound.”

Then, from the Whitehouse document:

“The decline in long-term interest rates over the past thirty years was real, global, and unexpected. While lower inflation explains some of the decline in nominal interest rates, the downtrend is evident even when adjusting nominal interest rates for the rate of inflation. The decline has also been evident across a wide range of countries, reflecting the increasing integration of the global economy. Financial markets and professional forecasters alike consistently failed to predict the secular shift, focusing too much on cyclical factors and missing the long-term trend.”

And:

“Nevertheless, expected future long-term interest rates a decade from now have also fallen substantially from what was expected by forecasters, or indicated by market forward rates, a decade or two ago. That decline suggests there may also be structural changes in the economy that will lead to lower equilibrium long-term interest rates even when the economy is fully recovered. Determining how long low long-term interest rates will persist and whether they will settle at a lower level than previously expected requires an evaluation of the reasons they are low today. While there is no definitive answer to this question, many factors suggest that longrun equilibrium long-term interest rates have fallen.”

(First Posted March 2016)