Understanding Stockmarket Trends and Turning Points

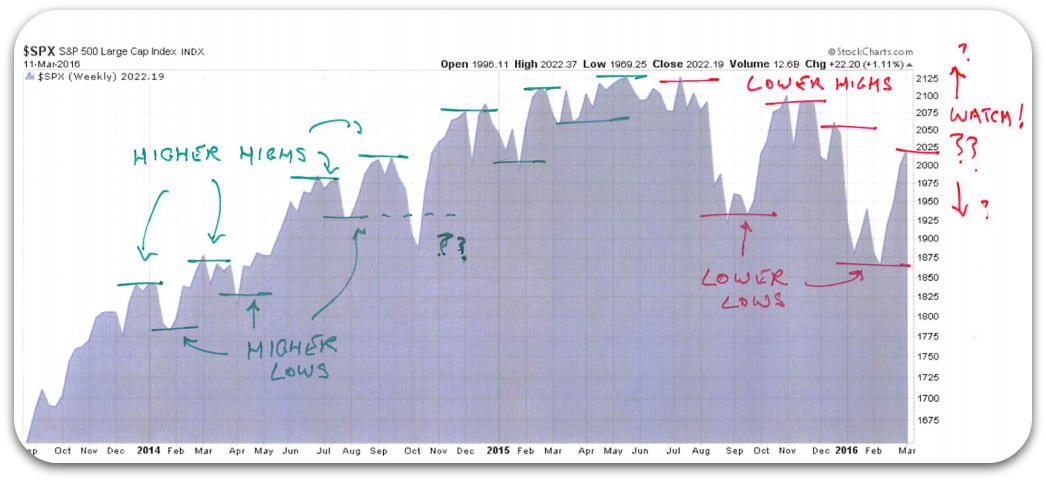

Have you ever heard the expressions “Higher highs” or “Lower lows” etc., and wondered what they actually meant? Read on….

Stockmarket indices and stock sectors tend to have longer term trends - a primary underlying directionality to the price movement. “Bull” means rising, “Bear” means falling. (There is also “Sideways”, implying no directionality but a balance of demand and supply.)

Fig: Bull & Bear Trends

Whereas day-to-day and week-to-week there may be secondary rallies and pullbacks (or sell-offs), these shorter term waves are superimposed on top of the underlying trend.

Fig: Shorter term stock rallies

Now let’s consider a few basics:

- Obviously, the periodic waves of peaks and troughs will either be with the underlying trend, or they will be against the trend.

- A bull market trend will therefore be characterised by peaks that are higher than last time (higher highs) and troughs that are also higher than last time (higher lows).

- A bear market trend is similarly shown by lower lows, and lower highs.

Fig: Superimposed stock rallies onto longer term trends

Short term traders such as intra-day and swing traders will naturally pay attention to the timing of the peaks and troughs. Long term investors generally shouldn’t care too much about the smaller rallies and pullbacks, except in the instance where the pulse of higher highs and higher low (or lower highs and lower lows) breaks down. This could mean a possible reversal of the longer term trend. We can’t immediately know whether what we are observing is an actual reversal, or whether this is a period of consolidation before the trend continues. To find out, we have to wait and see whether the price will break through it’s previous level (peak or trough).

A good example is happening right now with the S&P500. As mentioned a few days ago, there are some indications that the longer term primary trend has turned downwards. But in the shorter term the price has had four weeks of gains. So what does that mean? Well, if the price turns down before reaching it’s previous peak - a lower high - that will be in line with the idea that the longer term trend is downward. If however the price continues upwards and breaks past it’s previous peak level, that might be a sign that the years-long bull run hasn’t quite run out of steam just yet.

(First posted March 2016)