Blowing the Lid off the Biggest Scam in Big Business

The ability of a company to grow and increase earnings into the future underpins the value of the firm. The expectation of investors for earnings growth is reflected in the ‘price-earnings ratio’ (P/E), also called the ‘earnings multiple’. The P/E is the share price divided by the earnings per share. A company in a traditional low-growth industry will usually have a lower P/E than those in a more glamorous high-growth sector. For example, as of January 2016 the average P/E for the US Coal industry was less than 10, whereas the P/E for the Biotechnology sector was almost 50. Future growth prospects are attractive to investors, so driving demand for a company’s stock, pushing up share prices.

If the growth in a company’s share price outstrips the growth of earnings, then new investors will have to pay that increasingly higher price for a share of earnings - in other words the ‘earnings yield’ is decreasing. Earnings yield is the EPS divided by the share price, i.e. the reciprocal of the P/E. this can easily be seen in the chart below, which shows data for the constituents of the S&P 500 index.

Fig: S&P 500 - EPS (blue line) and P/E Ratio (red line)

In three years the S&P 500 earnings yield has fallen from about 5.5% to 3.96%, as the P/E has risen from 18 to over 25. So why are investors still buying stocks, driving up prices and thus obtaining a lower earnings yield? Well, in this time of low interest rates and low bond yields, investors accept a reduced earnings yield from stocks, because it’s still good enough (compared to bonds) to accommodate the risk of investing in equities.

So where is the scam?

The above would all be fine, if the ‘earnings’ that analysts and investors base their decisions on are reliably defined and not misleading. Shockingly this is often not the case, and the situation is getting more and more concerning to the SEC (the US Securities and Exchange Commission). Regulations specify that company financial reports must be filed in compliance with ‘GAAP’ (generally accepted accounting principles); however it is permitted for companies to also publish ‘non-GAAP’ figures that are ‘adjusted’ to be more representative of the ongoing performance of a company’s operations.

For instance, a company may write down assets or restructure operations, incurring one-off costs that distort profits and hence misrepresent earnings. That’s why many companies publish non-GAAP, adjusted, earnings statements (also called ‘pro-forma’ figures) that leave out these non-recurring items.

It is intellectually viable that non-GAAP earnings are useful to analysts when studying a company’s long term performance. But the danger lies in the huge opportunity for information to be presented in a misleading or deceptive way. When corporate profitability is under stress, it is simple human nature that individuals will wish to present earning statements in the most favourable light. Particularly if those individuals are remunerated in part dependent on stock price performance.

This danger prompted the SEC in May to tighten the crackdown on adjusted accounting measures. Here are some of the measures that the SEC has issued ‘guidance’ against (not a rules change):

- presenting a performance measure that excludes normal, recurring, cash operating expenses necessary to operate a registrant’s business;

- presenting non-GAAP measures inconsistently between periods without disclosing the change and the reasons for change;

- presenting non-GAAP measures that exclude non-recurring charges but do not exclude non-recurring gains; and

- using individually-tailored accounting principles to calculate non-GAAP earnings - for example, presenting non-GAAP revenue that accelerates revenue recognition as though the revenue were earned sooner than for GAAP purposes.

But it seems this is still too little to correct the false reality - the S&P has reached a new high in the last month, while GAAP earnings are lifeless on the floor. The chart below says it all.

Fig: S&P 500 GAAP Earnings (thick line) and S&P 500 price (shaded area)

The chart shows that in 2015, S&P 500 GAAP earnings fell by 14%. But over the same period, the adjusted ‘pro-forma’ earnings were flat! GAAP earnings were in fact about 25% lower than pro-forma - $787 billion (GAAP) versus $1.04 trillion (pro forma).

Just to be clear - non-GAAP pro-forma earnings are not real, they are made up, unaudited numbers.

The chart below shows the increasing divergence since 2013.

Fig: Enormous divergence between GAAP and non-GAAP (pro-forma) earnings

A survey of the 50 largest companies in the S&P 500 reveals that 28 of them issued non-GAAP earnings that were higher than GAAP, whilst only 3 had non-GAAP earnings lower that GAAP.

But wait - there is more sneakiness!

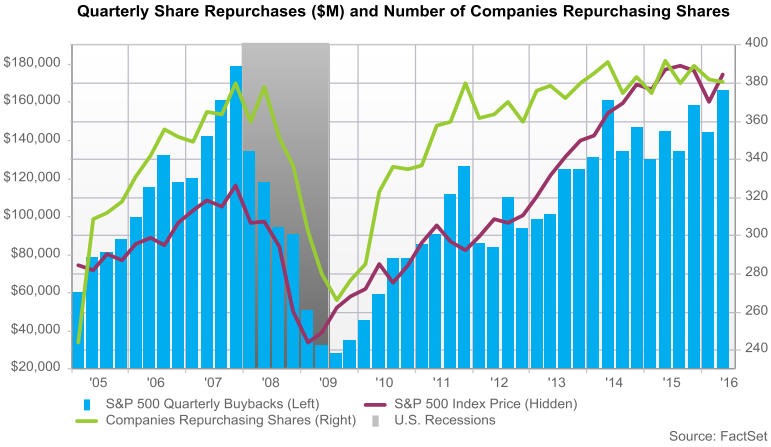

There is another way that companies can ‘manage’ their EPS - they can ‘buy back’ their own shares from the market, reducing the number of shares that are outstanding. This creates an instant increase in earnings per share - because there are now fewer shares (not more earnings). And of course at current rates they can borrow cheaply to do a share buy-back. How much of an issue is this? Well in the first quarter of 2016, almost one-third of S&P 500 companies cut their share count by at least 4%. The following chart is from FactSet.

How does this affect stock valuations?

Let’s work out a trailing P/E for the S&P 500 for 2015. Market capitalisation of the S&P 500 at end of December 2015 was $17.872 trillion on a free-float basis. Using the GAAP and non-GAAP earnings figures above we find:

- Non-GAAP (pro-forma) earnings basis - trailing P/E (31-Dec-2015) is 17.2

- GAAP earnings basis - trailing P/E (31-Dec-2015) is 22.7

So, we are left to wonder: as investors drive up stock prices still further, on what basis are they making their estimates of value? Because real earnings have been slaughtered - and the difference between fantasy and reality is over 30%.

(First posted August 2016)