Double Check Your Life Insurance NOW!

If you have a spouse or family that is dependent on your income, then you need life insurance.

The problem is, because that sounds initially like a lot of money, many of us don’t bother to work out the actual amount of life cover we need.

Moreover, we might not properly understand the terms of our employers insurance - does it apply at weekends? Holiday? What happens if I leave my job?

When I sit down with clients to find out what is the true level of life insurance needed, it’s not uncommon to discover that perhaps 10 to 12 times salary should be the basic minimum.

If you are an expat with life cover issued back in your home country - check your policy! Many onshore life insurance policies will not provide cover once you move abroad; in which case, your monthly premium payments are wasted.

Working out the life insurance cover you need

The purpose of life insurance is to fulfill your financial responsibilities if you die. Therefore, the first step is to get a measure of those commitments.

Lump Sum Responsibilities

You should plan your finances so that if you die then all major debts are covered, and all important future expenditures are accommodated. Several of the following are likely to apply:

- Remaining mortgage on your home

- Sum to cover 4 years of university fees and living expenses for each child

- Sum to pay off car loans and other debts

- Sum to cover expenses for your family to move back home if you are an expatriate

- Sum to cover funeral and associated costs

Additionally, some people like to include a life insurance provision for estate duties and inheritance taxes, as part of their overall financial planning.

Income Responsibilities

After the essential debts are paid, and funds set aside for future events such as university fees, the remainder of your insurance payout should be sufficient to create an income to pay for your family’s basic living expenses (as a minimum) for a number of years into the future. Using your current monthly expenditure as a guide, think about what annual income would be needed to make sure your family can live an appropriate lifestyle, and for how many years before they’re ‘on their own’.

Make sure to cover the most important person!

If you have children, then life insurance cover of the primary homemaker is essential, and at a level that will pay for ongoing childcare, cleaning and housekeeping, travel, tutoring and associated costs if something should happen to him or her.

Your advisor will discuss with you the size of fund needed to generate this income for the period needed. An income drawdown table can be a useful reference; or as a rough guide, simply multiply up the annual income needed by the number of years.

Existing provisions

In your calculations you should take account of existing provisions such your employers scheme, as well as income from other sources such as social security benefits, etc. The difference between your ideal level of cover and your current provision is the gap that must be accommodated by taking out a separate life insurance plan.

If your estimate for the total life insurance cover you need seems high, it’s probably right.

Review Every Year

You should review your level of life insurance cover regularly. Some of your lump sum obligations may have reduced (such as your mortgage) and some may have increased (such as your estimate for university fees). Income needs may change, for example as children grow up and become independent.

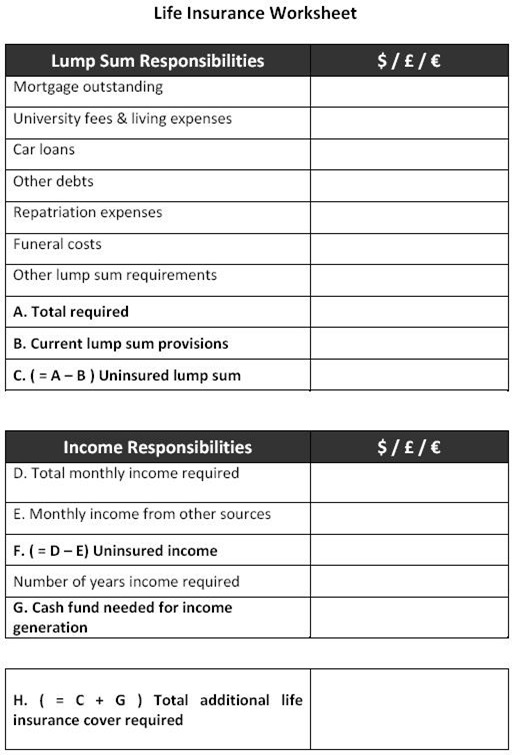

How to work out the amount of life insurance you need - life insurance worksheet

The following worksheet will help you calculate the amount of life insurance you need.

Click the image to download a PDF.

The two main types of life insurance

What type of insurance should you choose? ‘Term’ insurance is usually the cheapest option. You buy term insurance for the amount and the period required. When you stop paying premiums the cover expires, and there is no residual cash value.

In contrast, a ‘Whole of Life’ insurance plan has an element of investment. This can be useful for long term planning because their is the potential to build up a cash value in the long run. However, this can make such a plan’s monthly payments more expensive than a Term policy.

Term Assurance Policy: Term assurance is usually the most inexpensive type of insurance contract. Your premiums cover only the cost of the insurance benefits, and no residual cash sum is built up. When you cease making premium payments, the cover ceases.

Whole of Life Assurance Policy: A Whole Of Life contract has an element of investment within the contract, in which part of your premiums are used to build up a cash sum that may be accessed under certain future conditions.