Investment Outlook For 2018

After a nervous start to 2017 for investors, growth continued and the year ended on a higher note than most expected. As we enter 2018, it’s a good time to survey the global economy and decide if our asset allocation is still appropriate.In this article I aim to address these straightforward questions:

- Will there be a recession in 2018?

- How cautious should I be in my investment approach?

- Where are the investment opportunities for the year ahead?

- What asset classes should I overweight or underweight in my portfolio?

I will also reveal why an ox weight-guessing competition, held in 1906 at the West of England Fat Stock and Poultry Exhibition, helps us derive more useful information than individual leading economists do about the risk of imminent recession.

This is good stuff, you really should read on!

This is good stuff, you really should read on!

Review of Key Economic Reports

Remembering the First Law of Economists, it’s a good idea to conduct a broad survey of what the ‘experts’ have to say about the global economic outlook for 2018.I’ve looked at the latest reports from the following:

Governmental / Quasi-Governmental

- IMF

- World Bank

- OECD

- UN Dept. of Economic and Social Affairs

Independent

- Economist Intelligence Unit

Asset Managers

- BlackRock Investment Institute

- Allianz Global Investors

- Goldman Sachs Research

- Schroders Investment Management

To get a flavour I will snapshot the primary headline or theme in each case. In reverse chronological order:

January 2018

Allianz Global Investors – ‘Investment Strategy Outlook’

- The structural low-growth environment of the global economy persists: weak demographics and

productivity trends limit long-term growth prospects. Global growth will moderate in 2018.

- The global economy is in a temporary sweet spot. However, conditions will become less favourable, to the extent that 2017 probably represented the recent peak in economic growth.

- The world economy has strengthened as lingering fragilities related to the global financial crisis subside. Growth is expected to remain steady for the coming year.

- We are upgrading our global growth forecast for 2018, which marks a modest acceleration from 2017. Improving global trade and looser fiscal policy in the US account for much of this and, if our forecast is correct, 2018 will be the strongest year for global growth since 2011.

December 2017

BlackRock Investment Institute – ‘Global Investment Outlook 2018’

- The current economic expansion can last longer than many people think, but we see less room for upside growth surprises to lift markets.

November 2017

OECD – ‘OECD Economic Outlook’

- Global economic growth is strengthening, with incoming data surprising on the upside.

- For the first time since 2010, the world economy is outperforming most predictions, and we expect this strength to continue. Our global GDP forecast for 2018 is up from 2017 and meaningfully above consensus. The strength in global growth is broad-based across most advanced and emerging economies.

October 2017

IMF – ‘World Economic Outlook’

- The global upswing in economic activity is strengthening. Broad-based upward revisions in the euro area, Japan, emerging Asia, emerging Europe, and Russia more than offset downward revisions for the United States and the United Kingdom. But the recovery is not complete. Growth remains weak in many countries, and inflation is below target in most advanced economies. [Next issue to be published 22-Jan-2018.]

June 2017

World Bank – ‘Global Economic Prospects’

- Global growth is firming, contributing to an improvement in confidence. A recovery in industrial activity has coincided with a pickup in global trade, after two years of marked weakness.

Summary Review of the Reports

Unsurprisingly, a mixed bag of opinion, but with a clear tilt towards optimism for global growth in 2018. A significant portion of reporters upgrade global growth expectations for 2018, increasing from 2017. There is more bullishness towards emerging markets over advanced economies. In particular, SE Asia is seen as attractive. In advanced economies, capacity constraints (as slack is reduced), inflationary pressure leading to monetary tightening, higher interest rates, earnings growth worries and impact on stock valuations are all subjects of discussion; though stocks are not generally tagged ‘overvalued’ at the present time, supported by earnings.Hence, recession in 2018 is not considered very likely, though an end to the bull market is more so.On the back of record levels of consumer and business confidence, It is likely that sentiment, rather than fundamentals, is the current driving force behind growth in US equities.

It also comes as no surprise that political, security and other non-financial risks are prominent discussion points. Trump, North Korea, Paris Climate Agreement, rise of the political Right in Europe, Islamic terrorism, proxy conflicts in the Middle East, territorial disputes in the South China Sea,.. – they all feature. The difficulty with many non-financial risks is that they are binary, for example there is either a war, or there isn’t. For the private investor it is generally impractical to account for such factors in a strategy.

Interestingly, the analysis of the fully-independent Economist Intelligence Unit is possibly the most gloomy – maybe because they have to sell neither investments nor a rosy future. Where discussing possible risks to the downside, the EIU is not shy to use language like ‘will’ instead of ‘may’. Unusually in the group, the EIU not only predicts a recession, but puts a date on it too – 2020; followed by a bounce back in 2021 and 2022.

Discussion on 2018 Economic Growth Forecasts

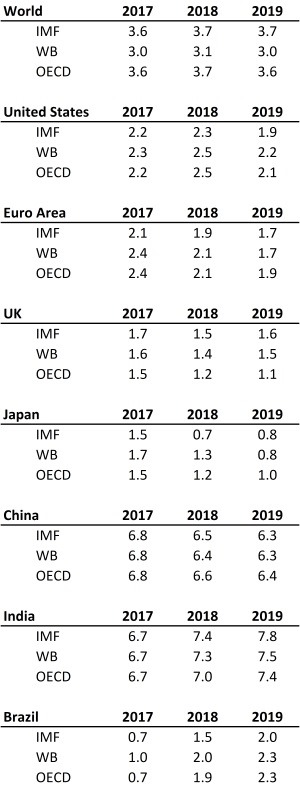

Comparison of Real GDP 2018 Growth Forecasts for IMF, OECD and World Bank

Naturally enough, because of methodological differences, no two data sets of the forecasts analysed are identical. In terms of status of organisation and resources applied to the data collection and reporting process, the IMF, the OECD and the World Bank produce some of the most-referenced data in the financial & economic industries. Comparing the GDP percentage growth data for key countries, we see general agreement on trends over the next couple years, notwithstanding differences in the absolute numbers.Table: Comparison of 2017-2019 Real GDP Percentage Growth Forecasts from IMF, OECD and World Bank (latest data as of date of this article)

All three of these organisations are highly credible and their reports and analyses are exceptional. The easy public availability of data from the IMF, via the IMF database, is very nice indeed.

The IMF also nicely tabulates a summary of world output for us, that helps put in context the table above.

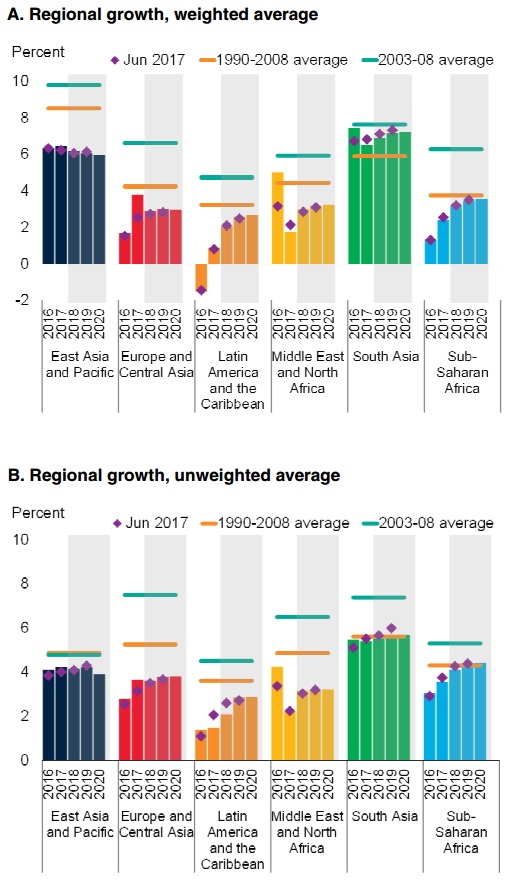

As a wealth manager, I am also a big fan of the World Bank’s analytic approach to EMDE’s (Emerging Markets and Developing Economies) by further subdivision between commodity exporters (who suffer from low commodity prices) and commodity importers (who benefit from low commodity prices). As you’ll see in the chart below, this is a useful dimension to consider when we examine the differences between EMDE’s, and gives us some good insights when we think about where the opportunities might lie for the next year or so ahead.

Forecast GDP Growth of Emerging Markets and Developing Economies by Commodity Importers/Exporters (World Bank)

The World Bank gives us an elegant chart of their forecast regional growth data. They tell us that growth in most EMDE regions with substantial numbers of commodity exporters is expected to accelerate as commodity prices rise and the impact of the earlier collapse in those prices dissipates. The robust pace of expansion in EMDE regions with a large number of commodity importers is expected to continue.

Source: World Bank.

A. B. Bars denote latest estimates and forecasts; diamonds correspond to Global Economic Prospects June 2017 forecasts. Average for 1990-2008 is constructed depending on data availability. For Europe and Central Asia, the long-term average uses data for 1995-2008 to exclude the immediate aftermath of the collapse of the Soviet Union. Shaded areas indicate forecasts.

A. Since the largest economies account for almost 50 percent of regional GDP in some regions, the weighted average predominantly reflects the development in the largest economies in each region.

B. Unweighted average regional growth is used to ensure broad reflection of regional trends across all countries in the region.

Here are the lists of countries that the World Bank defines as EMDEs, split by commodity importers and exporters (I have highlighted selected countries for quick visual reference).

EMDE Commodity Importers

EMDE Commodity Exporters

(* denotes energy exporters)

What the Bond Markets are Telling Us About The Economy

Bond Spreads

So with all this optimism for potential upside on global equities for 2018, what are the bond markets telling us about the economy? Well, pretty much the same thing.Corporate bond spreads are thin, indicating good things about the economy.The bond spread is simply the difference in yield between two bonds with different credit ratings. In comparison with US-government issued bond (T-bonds) that have the best ‘AAA’ credit rating, corporation-issued bonds will have a rating that reflects the credit-worthiness of the issuer. For instance a BBB-rated bond still counts as ‘investment grade’ but is not as highly rated as AAA. Hence a company wanting to issue BBB-rated bonds will have to offer buyers a higher return than government bonds, to account for the credit risk. However, if buyers of those bonds are in general quite optimistic about a corporation’s ability to service it’s financial commitments to bond holders, then they will collectively require a lower level of return than at other times.

Chart: Moody's Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity

(Source: FRED, Federal Reserve Bank of St.Louis.)

This spread is at it’s lowest point since 2007. Meaning that the extra return, over the treasury rate, that a corporation must offer to bond buyers, is at the lowest for ten years.

This reflects positively on the economy – bond buyers don’t need to be compensated so much for taking on the risk of buying corporate bonds.

Yield Curve

The yield curve on US Treasuries has for several decades been a supremely reliable predictor of recessions.Let’s briefly remind ourselves on the yield curve (also known as the term structure). It is the plot of yield (interest rates) versus maturity for US Treasury fixed income securities (i.e. government debt). The yield curve represents the ‘market’ position of all lenders to the government (bond buyers) as to what interest rate they require to lend for a particular maturity, and is therefore influenced by the aggregate supply and demand of the bond market.

The yield curve is normally upward sloping. This is because usually, lenders require a higher interest rate to persuade them to lend for a longer term. If lenders generally prefer to keep cash at their disposal in the shorter term (liquidity preference), there is greater demand for shorter-duration bonds, so rates are lower.

Occasionally, the yield curve becomes ‘inverted’ – i.e. downward sloping. This indicates that demand is increasing for longer maturity bonds compared to shorter maturities. This can happen because the market of lenders expect the economy to slow or decline (and in consequence a fall in interest rates), and so prefer to take the longer term yields on offer now, rather than preserve liquidity.

Chart: Flattening of Yield Curve During 2017

An inverted yield curve has correctly (and accurately – no false signals) predicted every US recession since the 1970’s.

So why is the yield curve such a good predictor of recessions?

Here’s the point where we can learn from an observation made by Sir Francis Galton (a cousin of Charles Darwin, and a very interesting fellow), at the West of England Fat Stock and Poultry Exhibition, held in Plymouth, England, in 1906. At this event, being a country fair, about 800 people entered a weight-guessing competition – the object in question was a fat ox, and entrants were invited to guess it’s weight after it had been slaughtered and ‘dressed’.

Here’s the point where we can learn from an observation made by Sir Francis Galton (a cousin of Charles Darwin, and a very interesting fellow), at the West of England Fat Stock and Poultry Exhibition, held in Plymouth, England, in 1906. At this event, being a country fair, about 800 people entered a weight-guessing competition – the object in question was a fat ox, and entrants were invited to guess it’s weight after it had been slaughtered and ‘dressed’. Now, it turns out that of all the expert butchers, farmers, and presumably many other non-expert folks enjoying a day out, nobody guessed the correct answer. However, the average of all the answers was almost exactly correct (and furthermore the guesses were normally distributed about the correct figure).

Galton called this effect ‘democratic judgment’, and reported his results in his paper ‘Vox Populi’ printed in Nature, March 1907. He demonstrated that a sufficient number of participants, all making their own independent judgments, can individually be mostly wrong, but collectively be extremely accurate. A simple version of this experiment is to imagine a hundred people being asked to guess the number of beans in a jar – most will be quite wrong, but statistically the likelihood is that the average will be spot on. (This subject is explored fully in James Surowiecki’s book ‘The Wisdom of Crowds’.)

And so we see that if the number of participants is the huge volume of buyers and sellers in an equity market, then the ‘correct’ price of a stock must of course be the one at that moment chosen by the crowd and currently reflected in the market.

Similarly, the vast number of global participants in the US Treasury bond market, all with their own opinions, will control the shape of the yield curve such that it reflects the collective wisdom of the crowd. And as we can see from the chart below, it is a near perfect recession predictor.

Chart: 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

(Source: FRED, Federal Reserve Bank of St.Louis.)

Chart shows the difference between the 10-yr Treasury yield and the 2-yr Treasury yield – i.e. the slope between those two points. Red circles highlight where the yield curve is inverted, because the slope has turned negative. Grey shaded regions are US recessions.

Right now, the yield curve may be flattening, but it is not yet inverted.

Portfolio Strategy For Bonds

We are in a situation of optimism on economic growth, record highs for equities, and the thinnest bond spreads for a decade. Therefore if we believe there is a low chance of markets turning bearish, we might shift our bond holdings slightly more towards high-yield, seeking returns.But, with one eye on the downside, we could instead choose to be careful about the makeup of our bond/fixed-asset holdings. We need to make sure they do actually behave like bonds in event of a market downturn. If our asset allocation says 40% bonds / 60% equity, we don’t want it to move like 30% bonds / 70% equity if there is a market correction or worse. For example, high-yield bonds can notoriously behave like equity in a bear market.

So if across our asset allocation, we choose to reduce bond holdings to get more exposure to the upside in emerging markets (for example), in parallel we should consider a slight shift towards proportionally more quality bond holdings, to ensure we get the two main attributes of fixed income we need – stability, and low correlation with equities.

Why We Have A Diversified Portfolio

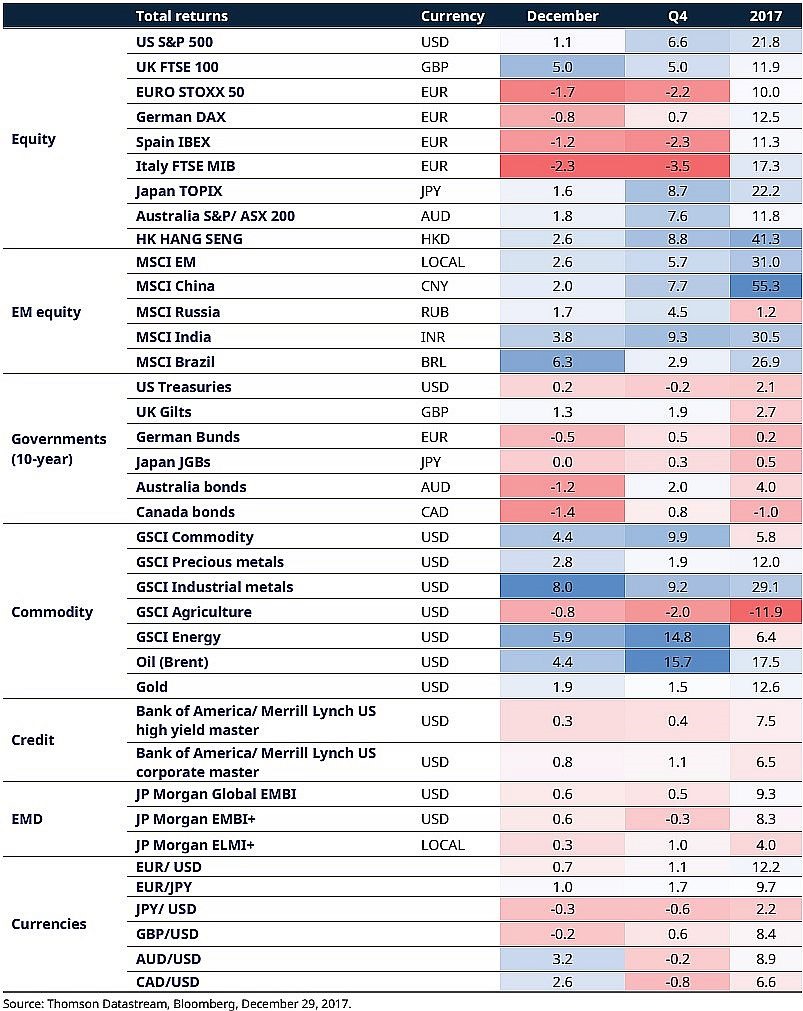

Before we jump straight in to look at the forecasts, let's have a quick overview of key market returns for 2017:Summary of Market Returns for 2017

We all know we can’t predict the markets, and nor can we even reliably forecast which asset classes, regions, or industries will perform the best from year to year. This is perfectly illustrated in the following table:

Table: ‘Periodic Table’ Randomness Of Returns For Different Assets, 2006-2017

(Table generated by Returns Web tool from Dimensional Fund Advisors.)

In the table above, for each year the different assets are arranged in order of their annual returns. For example you can see that in 2008, Emerging Markets performed worst of all at –53.33%. The following year in 2009, Emerging Markets performed best of all at 78.51%.

The benefit of a diversified portfolio is that the portfolio returns are less volatile overall. In the table above, the portfolio annual returns were always ranked either 3rd, 4th or 5th for the entire period 2006-2017. The pay-off is to sacrifice of some potential long term gains, for the benefit of a reduction of volatility.

Another way to display this is the performance chart for the same period. A ‘growth of wealth’ chart shows many times your wealth would have multiplied over the period.

Chart: Growth of Wealth for Different Assets, 2002-2017 (based USD)

(Chart generated by Returns Web tool from Dimensional Fund Advisors.)

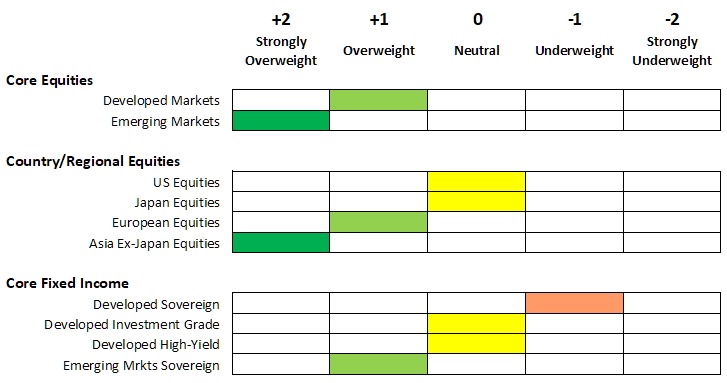

Your Baseline Asset Allocation Must Be Right For Your Long-Term Objectives

Your portfolio asset allocation – the relative share of each of your holdings – must ultimately be appropriate for your fundamental, long-term objectives. A young person saving for the future, with no need to access funds, can afford to be very adventurous and growth oriented. On the other hand, a person approaching retirement should be far more cautious and capital preservation oriented.As economic conditions change from year to year, every so often we might choose to tweak our asset allocation a little, to reflect confidence or otherwise in the individual assets. Tweaking means to vary holdings away from the baseline, by a few percentage points only, ‘overweighting’ on assets that are in favour, and ‘underweighting’ on those out of favour.

Bringing It All Together – Conclusions

- Will there be a recession in 2018? Probably not.

- How cautious should I be in my investment approach? We can be optimistic for the year ahead. But, keep a well diversified portfolio, and enough quality bond holdings in case of a correction; if there is one, it may turn out to be a buying opportunity.

- Where are the investment opportunities for the year ahead? Non-US developed markets. Emerging markets with a focus on Asia-Pacific.

- What asset classes should I overweight or underweight in my portfolio? Given the information presented in this article, one possible option is in the chart below ***.

To Finish Up – A Quick Reminder On The Fundamentals

Rule 1. Markets are efficient. In general, price-affecting information is broadly known and can be acted upon instantly. This means that individual assets are ‘fairly’ priced, given their relative position on the risk-vs-return scale.Rule 2. Hence, you can’t ‘beat the market’, because you cannot reliably spot opportunities that others haven’t.

Rule 3. Similarly, you can’t ‘time the market’, because you cannot reliably outguess others when to enter and exit.

Rule 4. Portfolio returns are driven by your asset allocation – the relative split between the different classes of bonds and equities. This has been proven in both academic research and practice over decades.

Rule 5. Investing requires a long term view, and time for the strategy to play out. We don’t switch holdings without a strategy; chasing profits is almost never advantageous (it’s like changing queues at the Post Office, only to see your original queue get to the counter first).

Rule 6. Properly diversify to reduce risk. A well diversified portfolio minimises overall volatility of our holdings.

Rule 7. Stay detached from the market’s manic fluctuations; and don’t bother worrying about the headlines in the financial press every day.

Happy Investing in 2018!

*** Important notice. This article is for information and discussion only. It is not a financial recommendation of any kind, and may not be appropriate to your individual situation. Always consult your financial advisor.

.