Reduce Risk, Remove Stress, and Access Market Returns

Dollar Cost Averaging II - How Any Investor Can Reduce Risk, Remove Stress, and Access Market Returns, Even In Times Of Market Volatility

One of the first principles of financial planning is to ensure that the worst case scenario doesn’t happen. Ultimately, this is a fundamental reason for diversification. Notwithstanding all the mathematics and academic research behind portfolio construction and investment strategy, one thing nobody wants to suffer is a disastrous life-impacting financial loss.

So what is ‘risk’ exactly? Well, it means different things to different people. In the world of financial academics, a common tool is variance measured as the standard deviation of thirty-six annualised monthly observations. This is the statistic used on many fund fact-sheets, and for example a fund with a standard deviation of 20% is deemed twice as volatile (twice as ‘risky’) as a fund with a standard deviation of 10%.

However, research shows that the basic variability of returns is not satisfactory on its own as a sole measure of risk for most investors. Downside risk is more significant than the upside to many of us. We don’t think in terms of statistical probabilities, we think with our gut. And of high priority is to avoid that terrible pit-in-the-stomach feeling that accompanies a major financial loss. The quest to understand how people act as investors in the real world is part of the relatively new field called behavioural finance, an important area for financial practitioners.

For example, suppose I offer you a choice between the following:

A. On the toss of a coin, if it falls heads you win $40,000. If it falls tails you lose $20,000.

B. I give you $10,000. No coin toss.

Which would you choose? In probability terms, the expected payouts are similar:

E(A) = 0.5(40,000) +0.5(-20,000) = $10,000.

E(B) = $10,000

But scenario A is far more risky because of the variance.

So what if I changed the bet in case A, and made it such that you’d win $100,000 on heads and lose $20,000 on tails? The statistical expected payout is now $40,000. Mathematically, scenario A is more attractive that B. If you could accommodate a loss of $20,000 then you might take the A bet. But if you couldn’t afford to lose $20,000, or were emotionally unprepared to accept that loss, you’d probably still opt for scenario B.

Insights of this kind into investor psychology are useful for financial advisors to understand when working with clients. For example, many people feel nervous or panic during a market crash, and may want to ‘get out at any cost’. In contrast, experienced and successful investors such as Warren Buffet are famously ‘greedy, when others are fearful.’

Whatever the reason for our attitude to risk - whether it’s inherent in our nature or acquired (for example through a major financial loss in the past), it’s important to be aware of the extent to which our investment strategy can be affected by emotional factors, and how that might impact the chances of achieving our future financial goals.

Shortfall Risk

Shortfall risk is the risk of not achieving some financial target at a certain point in the future. The gap between our target, for example the size of retirement fund, and what we actually attain, is the shortfall. The longer the period of time we have available to reach our goal, the more chance we have of meeting it. A long term time horizon means that not only do we have flexibility for a more aggressive investment approach in the early years, but we have the benefit of further years of income stream from employment. The closer we are to our target date, for example to retirement, the more important it is to pay close attention to investment risk, as well as maximise the benefit of our final years of income before we stop work.

Except for our needs for emergency cash and to fund major purchases, keeping a significant amount of cash in a bank is usually not helpful. In fact, we pay to keep cash in the bank - and we pay especially dearly in times of high inflation. For example, if long term the average bank rate is 1% and inflation is 4%, then our cash will have eroded in real terms by a quarter, over ten years. The gap between savings rate and inflation is a real cost, and ironically is usually more than the cost of investment products - a reason sometimes given for not investing.

Risk And Returns

So if we want to maximise our chances of meeting our financial objectives, it means using an investment strategy that provides a balance between a reasonable likelihood of the growth we seek by the end of our time horizon, and using all appropriate methods for risk reduction during that time.

As we all know, the core of risk reduction is diversification. But not everyone knows there are four dimensions:

- Asset class diversification - investing in a variety of different asset classes, for example equities, bonds, gold, property, commodities, etc.

- Geographical diversification - investing across a range of geographic areas, for example north America, UK, Europe, Asia-Pacific, etc.

- Currency diversification - investing in assets denominated in a variety of currencies, for example USD, CHF, EUR, GBP, SGD, AUD, etc.

- Time diversification - investing in selected assets at different points in time, to mitigate the risk that we get the market timing wrong.

The first three above are very well discussed elsewhere. Here, I intend to focus more on the fourth point - diversification in time.

What Is Time Diversification?

In some of the literature, the phrase time diversification is used to refer to the idea that equity investments might be considered less risky if there is a long time horizon. (In fact, this concept could be misleading, or simply wrong, if blindly followed.) But here, I use the expression time diversification in a sense equivalent to other methods of diversification - we are seeking forms of investment that are uncorrelated to each other.

For example, real estate can be a useful part of a portfolio because its price behaviour can be different to say bonds or equities (i.e. it’s coefficient of correlation to those asset classes is less than 1).

Similarly, the price behaviour of an asset bought and held for five years from 1st January 2010 will be different to the price behaviour of the same asset bought and held for five years from 1st January 2011.

Time diversification is about reducing market timing risks - i.e. reducing the chance that we’ve made mistakes of timing in either the buy or sell points of the investment cycle. Hence, there is entry-based time diversification and exit-based time diversification.

Exit-based time diversification for a retirement plan usually happens naturally because when we retire we don’t suddenly cash in 100% of our fund on one day, but instead remain invested and draw down an income during our remaining years (unless we are relying solely on annuity-based income in retirement).

Entry-based time diversification is more famously known as dollar cost averaging.

Dollar Cost Averaging

Dollar cost averaging (DCA) is an investment strategy that involves purchasing a fixed dollar value (or other currency) of units or shares in a security, on a regular basis (for example monthly), regardless of price direction of the security. If the price declines, then more units will automatically be bought at the lower price; so overall the net price paid per unit is below the average price during the investment phase. Hence when the price recovers after a dip, profits are increased.

In a true statistical sense, DCA is sub-optimal, because in a rising market profits would be higher if a lump sum is invested right at the beginning; and in a volatile market profits would be improved by fully investing at the lowest point. However, very few people can time the market to a useful degree, and moreover most people who employ DCA do so through an automatic plan for regular savings from earned income (because in the long run, the best time to invest is when you have the money!).

Notwithstanding the fact that most people automatically benefit from DCA through a retirement savings plan from earnings, DCA is an excellent way to reduce investment risk for a lump sum that would otherwise be invested all at once.

A significant and important advantage of DCA as a way of drip-feeding a lump sum into the market is that it helps deal with some of the emotional factors that can impair execution of the most effective and simple investment strategy of all time - buy low, sell high.

Why Do Investors Have Difficulties To Buy Low, Sell High?

In the long run, markets tend to rise. So if your time horizon is long enough, there’s an excellent chance of positive returns. Warren Buffet’s favourite holding period is - forever.

But in practice, people aren’t always able to view investing with the same long term perspective: maybe we’re only a few years from retirement, perhaps we have interim needs for cash such as education fees, or unplanned needs due to health emergencies. Also, even if we believe that we do have a long term horizon, irrationality and panic can take over when we least need it: risk aversion can delay our market entry from the optimal because we want to ‘wait and see’; irrational performance chasing can lead us to buy into overvalued investments; and panic can make us want to ‘get out at any cost’ at precisely the wrong time. Too often, private investors buy in at the top of the market, and sell at the bottom. The exact reverse of buy low, sell high.

This is where the full benefit of DCA is revealed. By reducing market timing risk, even risk-averse individuals can access returns from the market, worry less, and be more confident investors.

Dollar Cost Averaging - A Real World Example

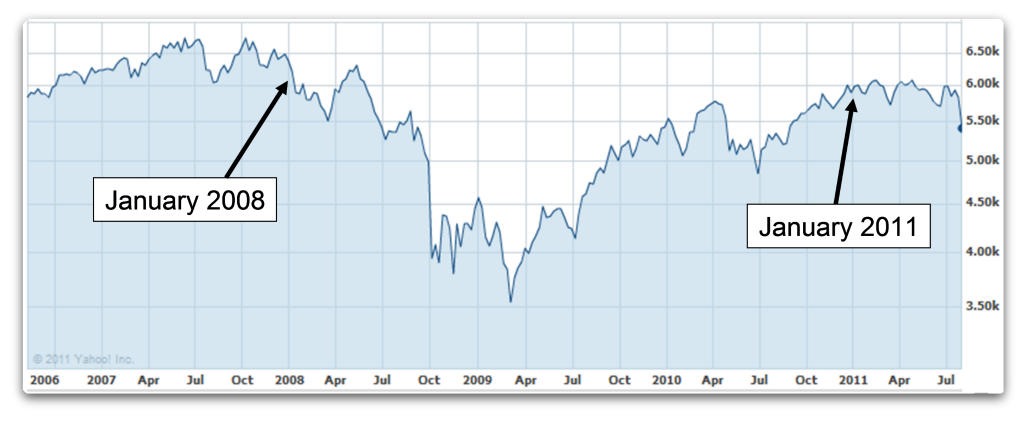

Let’s look at the chart of the FTSE100, below:

Take yourself back to January 2008. Here’s the market headlines from 5th January 2008 on FT.com:

The major indices were all in the red, and the headlines were gloomy.

Now, imagine that you had GBP £200,000 to invest. You can’t see what the future holds, and have no idea of the global crisis to come. But you believe in the long term future of the economy; and anyway, you’re investing with a long time horizon. In that case, you might see the recent volatility as an opportunity, so you invest £200,000 into the market.

A year later, and you’re down by 30%. Gulp. It turns out, you decided to invest at probably the worst time in the last decade. How do you feel? Commonly, it’s intense regret, a sense of loss, stress and worry. Maybe you stop reading the financial news. Maybe you even stop looking at your investment performance, because it makes you feel unwell. Perhaps you tell your broker or advisor to get you out of the market completely, and you walk away; locking in your losses.

Hold that thought. Now let’s look at what DCA can do for us.

Let’s say, instead of investing £200,000 all on one day, you decided to time diversify - dollar cost average - over 40 months, investing £5,000 per month. If you had set up such a plan, what would be the result?

Suppose that we can ‘buy’ the FTSE100 index as though it was a unit trust or similar investment, and the unit price is the index value in pence (e.g. if the index is 6029.2, then the unit price is £60.292). So, it’s easy to see how many units our £5000 is buying each month.

FTSE100 Monthly Prices From End Jan-2008 to End April-2011

A reminder: if you had invested a single lump sum of £200,000 in January 2008 (when the index was 6029.2) then after the crash you’d have to wait until April 2011 for a recovery back to the starting level. 40 months in the market for plenty of stress, but no gains.

But if you had used DCA to drip-feed money into the market? After 40 months you’ve accumulated 3885.893 units. And the unit price is £60.699. So, the value of your investment holding is £60.699 x 3885.893 = £235,869. That’s a gain of 17.9%.

Yes, that’s right. Starting from the brink of the worst financial crisis in a lifetime, dollar cost averaging into the FTSE100 would have yielded a return of 17.9%!

A simple investment strategy, and the power of straightforward mathematics, has delivered results that almost seem like black magic.

But there’s more: the emotional side. Consider how you might feel as an investor if you were dollar cost averaging your funds into the market as it was tumbling. If you had an understanding of the benefits of DCA, possibly you’d be rubbing your hands with glee! While everyone around you is panic selling (and it could have been you), instead you are stock-piling large volumes of units at knock-down prices.

In summary, the DCA strategy continually demonstrates a real-world ability to reduce risk and allow investors to sleep well at night - even while markets are crashing.

DCA Theory

Sir Arthur Stanley Eddington (1882-1944), English astronomer and physicist, once said it is a good rule not to put overmuch confidence in observational results until they have been confirmed by theory. Bearing this good advice in mind, let’s look at some of the academic research and theory that backs up the practical benefits of DCA.

Discussions of asset class diversification go back sixty years to Harry Markowitz’s initial work in the 1950’s; since then a substantial body of research has been built upon those foundations. This is not the case with DCA, which has been looked at less closely (somewhat surprising given that it is employed so much by investors worldwide). Nevertheless there are a number of important and useful academic papers on the subject of DCA. A common feature of the academic work is that due to the nature of the subject, it is highly mathematical.

Constantinides

George Constantinides in his 1979 paper ‘A Note on the Suboptimality of Dollar Cost Averaging as an Investment Policy’ was an early identifier of the fact that there’s no free lunch even with DCA. A strategy that reduces risk will sacrifice returns compared to the theoretical optimal strategy in any given situation. Whilst being mathematically sound, this and similar papers were at a loss to explain the popularity of DCA, and it’s promotion through books such as Burton Malkiel’s ‘A Random Walk Down Wall Street’ arguably one of the most influential books of it’s era for the private investor.

Constantinides does make the important point that the mathematics does not take into account any income or capital gains taxation, which are ignored in all of the literature reviewed, as are transaction costs for DCA strategy implementation.

Dubil

In 2004 Robert Dubil published his paper ‘The risk and return of investment averaging: An option-theoretic approach’, which specifically looked at the risk reduction of DCA in terms of expected shortfall, rather than it’s theoretical suboptimality. Dubil showed that the risk reduction due to averaging is significant not only in terms of standard deviation, but also in terms of expected shortfall of funds when the investment turns a loss. As discussed earlier, the latter measure of risk is equally if not more important to the typical investor. Dubil showed that the DCA benefits are greater, the longer the averaging, and the riskier the underlying investment.

Dubil specifically discusses the fact that investors are not ‘rational’ in the traditional sense and that ‘the advantages of DCA can be more clearly seen through the prism of behavioural finance’.

Dubil’s research showed that: In the most extreme cases of long averaging periods relative to the total investment horizon (five-year averaging with a five-year horizon), we show that DCA reductions of 40% for standard deviations and 30% for expected conditional shortfall. Personal investors do care by how much (in dollars) they are likely to miss their retirement targets.

Dubil also notes that DCA is intuitively diversification: a DCA investor buys ‘chunks of stock non-perfectly correlated to each other’. DCA ‘always reduces the expected dollar amount of shortfall upon liquidation of the investment.’

Dubil: Long-term investors should choose low risk assets for long buy-and-hold strategies and invest in them early. They should choose high-risk assets for DCA strategies and try to extend the averaging periods.

Brennan, Li & Torous

In 2005 Michael Brennan, Feifei Li and Walter Torous published ‘Dollar Cost Averaging’, in which they found that for an investor who is purchasing a diversified investment portfolio, a DCA strategy carried out over implementation period from one to six years outperforms the lump sum investment strategy for all except the most risk tolerant investors.

In resonance with Dubil, Brenna et al say that ‘the DCA prescription is that it should be applied to the purchase of securities that are being added to portfolios that are already well diversified.’

Brennan et al: In summary we find that dollar cost averaging, when applied to the addition of a stock to an existing portfolio, has benefits that have not received attention in the academic literature despite the fact that investment practitioners have tended to advocate the strategy for many years. It appears to be a case in which practical wisdom has discovered what theoretical knowledge has yet to attain.

Trainor

Also in 2005, William Trainor published ‘Within-horizon exposure to loss for dollar cost averaging and lump sum investing’. His paper is important because it looks at expectation of loss not just at the end of the investment time horizon, but within the horizon. This is of course highly relevant to risk-averse investors who - although they know that they are investing for the ‘long run’ - nevertheless struggle emotionally when faced with portfolio losses during the investment period.

Trainor presents his results: As can be seen, both the end-of-horizon and within-horizon probability of suffering a particular loss is smaller under the DCA strategies relative to LS (lump sum) investing, and the longer the averaging, the more dramatic the decline. This is particularly the case for within-horizon risk.

Trainor looks not just at the probability of shortfall and the conditional expected shortfall, but the expected time of shortfall - i.e. for how long the investment will be in negative territory. These findings are also highly relevant. For example, for a five-year DCA strategy and a five-year horizon, DCA reduces the expected time of any shortfall from 28.8% for a lump sum (i.e. almost a year and half) to 7.3% (i.e. just over four months). The probability of any shortfall within-horizon (i.e. at any time during the five years) falls from 90.7% to 48.3%, and the conditional mean expected shortfall falls to 35% of its value in the lump sum case.

In summary, Trainor conclusively shows that DCA significantly reduces the probability of shortfall, as well as the magnitude and time of such shortfall: DCA clearly can be an attractive strategy when considering risk throughout the investment horizon. The reduction of this risk can be relatively dramatic. A DCA averaging period of sufficient length (at least three years), can substantially reduce the within-horizon shortfall probability, the conditional expected shortfall, and the expected time one has to endure a wealth level below the initial investment.

Towards A Practical Strategy

Practical strategy is guided by both observed results and academic theory. For almost any investor except those imminently at retirement, there can be significant benefits to employing a DCA policy.

Investors saving for a long term objective such as retirement will automatically benefit from DCA into a properly constructed portfolio during the course of the plan. For such savers, DCA can be seen as a way to accumulate wealth whilst potentially benefiting from market volatility. Note that DCA does not remove the need to periodically review the portfolio and when markets are up to rebalance, locking in profits from the riskier assets and buying additional less risky assets to hold for the long term. Such savings plans might typically have a time horizon of between ten to twenty-five years.

Investors looking for growth of a lump sum can also benefit from DCA as a way to significantly reduce risk when adding more volatile assets as an important part of a diversified growth portfolio. Such DCA strategies might have a time horizon of between three to six years, or longer depending on the circumstances and attitude to risk of the investor.

DCA, as one form of diversification, should be used in conjunction with the others: asset class diversification, currency diversification and geographical diversification. This implies an investment product designed for regular savings into a broad range of assets denominated in a range of currencies.

Finally, to best realise the benefits of DCA specifically, transaction costs should be very low and the product should provide tax-efficiency or tax-deferral for the period of the time horizon.

Bibliography

George Constantinides: ‘A Note on the Suboptimality of Dollar Cost Averaging as an Investment Policy’, Journal of Financial and Quantitative Analysis, 1979.

Robert Dubil: ‘The risk and return of investment averaging: An option-theoretic approach’, Financial Services Review, 2004.

Michael Brennan, Feifei Li and Walter Torous: ‘Dollar Cost Averaging’, Review of Finance, 2005.

William Trainor: ‘Within-horizon exposure to loss for dollar cost averaging and lump sum investing’, Financial Services Review, 2005.